Facebook Blogging

Sunday, September 07, 2008

Building Permits Down In Turkey In Q2 2008

In the first six months of 2008 compared to the first six months of the previous year, considering the Construction Permits, the number of residential buildings fell down from 47 053 to 39 851, decreasing by 15,3 %. During the same period, the floor area of residential buildings fell from 43 871 844 m2 to 37 477 625 m2, a decrease of 14,6 %.

Obviously we can expect no GDP "uplift" from construction in the immediate future.

Wednesday, September 03, 2008

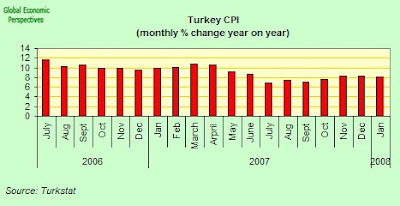

Inflation Eases Back Slightly In Turkey In August

The fall in the consumer price index was mainly due to reduced clothing and footwear prices, which were down 6.5 percent, as the summer sale session continues, as well as a fall of 1.55 percent in transport prices. Housing prices, on the other hand, increased by 2.12 percent in August.

The significant decrease in the monthly producer price index was mainly due to a 3.14 percent fall in prices in the manufacturing industry sector, in combination with a 2.41 percent fall in the industry sector and 1.99 percent fall in the agriculture sector.

Despite the fact that energy prices rose 5.69 percent this increase failed to push up the producer prices index. The Turkish Central Bank expects the 2008 year-end inflation rate to reach 10.6 percent, while the bank also estimates it will be somewhere in the rather large range between 5.9 and 9.3 percent in 2009, before dropping to a level of between 4 and 7.8 percent towards the end of 2010. These longer term predictions seem to me to be virtually worthless at this point, since we simply do not know what will happen to energy and food prices in 2009. The former depends to some considerable extent on the pace of output growth across the emerging economies, while the second depends to some significant extent on the weather, over neither of which factors the Turkish bank has any significant control.

Sunday, August 31, 2008

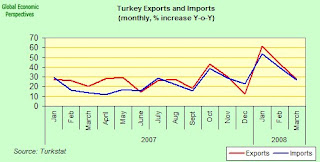

Turkeys Trade Deficit Widens In July

Over the January-July period exports grew 39% in 2008 compared with 2007, to 81,397 Million Dollars while imports grew 36.6% in 2008 compared with 2007, to 126,380 Million Dollars.

At the same month, foreign trade deficit raised by 26.7%, reached from 6,276 Million Dollars to 7,954 Million Dollars. While during the January-July period the foreign trade deficit was up by 32.4% over the same period in 2007 and reached 44,983 Million Dollars.

Evidently the evolution in the trade deficit, which may be mostly about energy, is a growing cause for concern.

Germany and Russia are the main partners...

The weight of the EU in Exports has continued in July 2008. As compared with the same month of the previous year, exports to EU were 6,092 Million Dollars and increased by 23.3%. The proportion of the EU countries was 48.4%.

In July 2008, the main partner for exports was Germany with 1,227 Million Dollars and increased by 24.7%. For exports, Germany was followed by UAE (968 Million Dollars), Italy (839 Million Dollars) and The UK (776 Million Dollars). For July 2008, the top country for Turkey’s imports was Russia (3,146 Million Dollars), records for imports range from Germany (1,789 Million Dollars), USA (1,474 Million Dollars) and China (1,426 Million Dollars).

And again, as we have been seeing, the current dependence on Russia is becoming rather problematic, and possibly just as worrying as that trade deficit.

Turkey spent a good part of last week protesting to Russia over trade restrictions after trucks were held up at customs posts, hurting exports to Turkey's biggest trading partner. Russian customs inspections, which previously took a few hours, are delaying the entry of Turkish trucks for as long as 20 days, according to an official at Turkey's Trade Ministry. The ministry estimates Turkey could lose as much as $3 billion in exports if the curbs continue, and has sought an explanation from the Russian government.

Russia last year was the largest market outside the European Union for Turkish goods, with $4.9 billion of exports, according to the Turkish Assembly of Exporters. Turkey sells textiles and food to Russia, and relies on imports of Russian natural gas for heating and electricity. The restrictions are especially damaging for Turkish textile exporters who are currently selling their winter collections, Trade Minister Kursad Tuzmen said yesterday. Textile and clothing exports were Turkey's biggest foreign currency earner last year, bringing in $22.6 billion to help cap a trade deficit that's widening as energy costs rise.

Turkish Builder Enka Hit Hard

Enka Insaat & Sanayi AS, Turkey's biggest builder, and brewer Anadolu Efes Biracilik & Malt Sanayii fell the most in more than a year in Istanbul trading last week on concern that they may lose business in Russia as a result of tensions in the Caucasus.

Investors are concerned that Enka, which has won contracts to build airports and power stations in Russia and modernize Russia's parliament buildings, may lose out as the military conflict in Georgia hurts Russia's relations with the North Atlantic Treaty Organization or NATO, in which Turkey is a member. Anadolu Efes beer sales in Russia have surged as the company acquired local brewers.

Almost half of Enka's backlog of orders are in Russia, and more than half its assets are in Russia and other CIS countries, Hackett said. Enka owns the Ramstore chain of supermarkets in Russia.

Tuesday, August 19, 2008

Turkey Country Outlook August 2008

by Edward Hugh: Barcelona

Executive Summary

Turkey’s economy grew at a 4.5 percent in 2007. The economy accelerated to an annual rate of 6.6% in the first quarter of 2008. Thus despite being faced with a series of major headwinds – the June 2006 lira crisis, the August 2007 sub-prime turmoil, the threat of having the governing party banned and a global food and energy price shock – the growth momentum of the Turkish economy has been maintained.

Headline inflation had been on a downward path, but started to pick up in the second half 2007 on the back of escalating food and energy prices, and reached an annual rate of 12.1 percent in July. Core inflation has been lower, but has followed a similar trajectory; reaching 6.8 percent in July and thus headline inflation has continued to remain above the central bank 2007 target of 7.5%. The central bank has, rather belatedly, begun a process of monetary tightening, with three 50 bp rises at three consecutive meetings before pausing in August. We do not anticipate any additional tightening in the immediate future as we feel the bank will watch and wait to observe the future course of oil and food prices.

Turkey’s current account deficit stabilized temporarily in 2007. Despite an appreciating lira, export and tourism performed tolerably well throughout the year, supported largely by earlier productivity gains. Import growth was weak in early 2007 (reflecting sluggish domestic demand and the lagged effects of the mid-2006 depreciation) but gradually regained strength as the lira once more rose and oil prices surged. The current account deficit was 5.7 percent of GDP for the full 2007 - down from 6.0 percent in 2006 - but the gap has been widening again in recent months.

Fiscal resolve in Turkey’s AKP governing party predictably weakened considerably in 2007 – an election year. Stripping out one-off factors, which buoyed fiscal performance in 2006, fiscal policy was scheduled to tighten considerably in 2007 .In the event, the envisaged discretionary tightening did not materialize: the 2007 nonfinancial public sector primary surplus was 1.5 percent of GDP less than forecast. The Turkish authorities are now targeting a primary surplus of 3.5 percent of GDP to create additional fiscal space for infrastructure investment (including major projects in poorer southeast areas), labor market reform, and higher transfers to subnational governments. The authorities view this stance as appropriately balancing macroeconomic concerns against microeconomic needs, and we by and large concur. It is also politically both wise and expedient in the view of the tensions which exist inside the country and the serious need for political stability if the desired macroeconomic reforms are to be implemented.

Country Outlook

In the midst of all the recent political debate and tension surrounding Turkey – and in particular the recent legal initiative to ban the governing party, the AKP - one feature stands out above all the rest: the extent and duration of the economic revival which Turkey has experienced since it left the deep recession experienced in 2001. It is clear that something has changed in Turkey, and in a quite remarkable way. The application of well-founded economic policies, anchored in an ongoing EU accession process and backed-up by a steady flow of International Monetary Fund reviews and arrangements, has served to provide Turkey with a greater degree of political and economic stability than was normal in the past and this, when added to the extremely favorable external conditions which characterised the global environment until August 2007, have produced in the Turkish case an impressive average annual GDP growth rate of 6.8% in the years between 2002 and 2007.

Perhaps more than the performance during the good times, what is most remarkable about the recent Turkish performance is the stability it has shown in the face of adversity. Prior to 2001 the Turkish economy had been characterized by a series of boom-bust cycles which were normally accompanied by extended periods of financial fragility. However, political consolidation post 2002 and a much more favorable demographic environment have led to both growing economic rationalization and to a considerable reduction of business-cycle volatility. The volatility of real GDP growth (or any other macro variable, for that matter) has declined to historically low levels post 2001, while total factor productivity growth has surged to around 5% a year.

Since the heady days of 2004 the Turkish economy has had three significant headwinds to contend with: the run on the Lira of June 2006, the sub-prime troubles of August 2007, and the decision by the Constitutional Court to hear the case in favour of banning the governing AKP. In each case risk aversion towards Turkey has increased. – although in each case as can be seen in the chart below with reducing intensity – and in each case the Turkish economy (whilst slowing) has stubbornly refused to be deterred from its course. The general picture can best be seen from the USD-TRY chart, which has three identifiable peaks: the June 2006 run on the Lira, the outbreak of the sub-prime turmoil and April 1, the day the Turkish Constitutional Court decided it was going to hear the case against the AKP.

Of the three the worst was undoubtedly the capital outflow hemorrhage which hit Turkey’s financial markets in June 2006 and brought about a very sharp depreciation in the value of the lira - at one point the drop was 19.0% against the dollar and 21.3% against the euro - all in the space of just four weeks. The impact of the outflow was such that the 5-year bond yield increased by 460bp from 13.4% to 18.0% over the same period, an up-jerk which naturally lead to a sudden contraction in the availability of domestic credit. Faced with the severity of the shock which hit the Turkish economy the central bank had little alternative but to move aggressively, with the central bank policy rate being raised from 13.2% to 17.25% in the space of just 20 days.

Now in each of these shocks has also been followed by some sort of slowdown in the Turkish real economy. The growth rate slowed in 2006 from a year on year 9.7% in Q2 to 6.3 in Q3 and in 2007 from an average annual rate of 5.7 percent in the first half to 3.4 percent in the second. The 2007 slowdown was the result of a variety of other factors, notably a sharp drought-related drop in agricultural production (which subtracted 0.75 percentage points from 2007 growth) and a deterioration in net exports, reflecting the generally stronger lira over 2006 (it was up 19 percent in real effective terms in 2007).

GDP growth started to accelerate again in the first quarter of 2008, but the stronger performance is not expected to be repeated in the second quarter, since alongside the political crisis and drop in confidence that this produced, Turkey has also seen, along with most other emerging economies, accelerating inflation and monetary tightening from the central bank. In general terms the strength of the expansion post June 2006 has been much weaker, and this can be largely attributed to a rapid drop in the expansion of construction activity.

Some slight recovery in construction activity can in fact be noted in the first quarter of 2008, and this to some extent coincides with a rebound in the expansion of domestic private credit which after falling back from an annual pace of expansion of around 80% in June 2006 bottomed out at around 30% June 2007, and by March 2008 was back up at a year on year growth rate of around 45%.

Recent quarters have also witnessed a steady build up in invesment in machinery and equipment, which is basically a very healthy sign since it can be read as showing confidence in future end user demand growth.

Inflation and the central bank response

At the same time supply-side energy and food shocks have also slowed Turkey’s growth at the same time as stoking up inflationary pressures. To reverse the recent surge in inflation, the central bank has halted its earlier easing cycle and moved over to a clear tightening bias.

Energy items, which represent 11½ percent of the HICP basket in Turkey - were supportive of disinflation during the first half of 2007, as lira strength and an administrative freeze on utility prices temporarily shielded consumers from rising world market prices. Since last October, however, the surge in oil prices has clearly made its presence felt on domestic inflation. In addition, food prices – which constitute 28.5 percent of the basket - have continued to exert upward pressure. As a consequence the central bank reported in their last inflation report that 6.8 percentage points of the 10.61 percent annual CPI inflation in June resulted from the direct impact of food and energy items. Of course, another way of looking at this is that 3.81 percentage points came from other factors, and this is just what the IMF staff economists pick up on in their latest report.

The central bank argues that elevated food inflation continues to be the main factor impeding the disinflation process. They suggest that even though domestic weather conditions became more favorable in the first half of 2008, the lagged effects of last year’s poor harvest and high global agricultural commodity prices have continued to keep processed food inflation at high levels. As a consequence, processed food inflation saw a cumulative increase of 14.2 percent in the first half of 2008. In July the annual rate of CPI increase excluding food, energy, tobacco and gold stood at 6.54 percent, suggesting to the central bank that “the breach of the inflation targets can be mostly attributed to factors beyond the control of the monetary policy”. The IMF economists do not agree, and have themselves computed a “virtual” inflation series by applying Turkey’s basket weights to average EU-27 inflation rates for detailed HICP components and then comparing the results. This virtual rate is an attempt to capture the impact of pan-European price trends, which in the case of Turkey are magnified by the relatively high weight of key items (especially food) in the national basket. What the IMF economists found was that while EU-wide trends explain most of Turkey’s very recent inflation dynamics, the general high level of inflation clearly remains a domestic Turkish phenomenon.

The key risk for the Turkish inflation outlook is that the recent supply-side shocks will produce lasting second-round effects. Inflation expectations had been on a steady downward path but have risen sharply again in recent weeks. Moreover, the latest monthly numbers on core inflation - 6.54% in July - do point to a problematic broadening of price pressures, also related to the lira depreciation early this year.

Turkey's central bank left its benchmark interest rate unchanged at 16.75% last week, pausing for the time being a rate hike exercise that has seen three months of consecutive 0.5 percentage point increases. The central bank now hopes that Turkey's key rate, which is now the highest among developed and emerging economies, together with the recent drop in oil prices, and the renewed rise of the lira (which is now up around 12% since it hit a 2008 low of 1.3470 against the dollar on April 1) will all help to slow the pace of consumer-price growth.

Current Account Issues

Turkey’s current account deficit stabilized temporarily in 2007. Despite an appreciating lira, export and tourism performed tolerably well throughout the year, supported largely by earlier productivity gains. Import growth was weak in early 2007 (reflecting sluggish domestic demand and the lagged effects of the mid-2006 depreciation) but gradually regained strength as the lira once more rose and oil prices surged. The current account deficit was 5.7 percent of GDP for the full 2007 - down from 6.0 percent in 2006 - but the gap has been widening again in recent months.

In general Turkey’s external position has improved considerably, and the external debt-to-GDP ratio still fell to 34 percent of GDP by end-2007 (down from 44% in 2003, with the improvement due largely to the lira’s sharp appreciation and strong nondebt-creating inflows). Foreign exchange reserves stood at $76.5 billion at the end of 2007, up from $35.2 billion at the end of 2003.

External financing was ample during 2007, but turmoil in global markets has since been exerting an influence on financing conditions. FDI inflows were buoyant in 2007, driven by mergers and acquisitions in the financial sector, and covered half of last year’s current account deficit. Equity market inflows and long-term corporate loans also were robust. This abundance of external financing allowed the central bank to increase international reserves considerably, but more recently external financing conditions have tightened in many areas - foreign investors have scaled back their portfolio holdings, securitized bank lending has all but ground to a halt, and spreads on syndicated loans have widened.

The Fiscal Dimension

Fiscal resolve in Turkey’s AKP governing party predictably weakened considerably in 2007 – an election year. Stripping out one-off factors, which buoyed fiscal performance in 2006, fiscal policy was scheduled to tighten considerably in 2007 .In the event, the envisaged discretionary tightening did not materialize: the 2007 nonfinancial public sector primary surplus was 1.5 percent of GDP less than forecast. In particular, with growth moderating, it proved difficult to enforce the envisaged spending restraint in an election year. On the revenue side, the main problem has been (and is) weakness in collections linked to consumption, reflecting slow spending for durable goods, as well to a drop in compliance and tax arrears (of around 0.25 percent of GDP) from an ailing state energy enterprise which was unable to raise tarrifs. Nonetheless debt continued to decline rapidly in 2007, helped by lira appreciation and privatization receipts. The overall fiscal balance was a deficit of 1.4% and total debt to GDP was down to 38.8% of GDP (down from 67.4% in 2003). The Turkish authorities are targeting a broadly neutral fiscal stance for 2008 and there seems to be a general consensus that the primary surplus target of the last five years (5 percent of GDP) which formed the cornerstone of earlier macroeconomic success is not necessarily appropriate in the present environment. With gross public debt down to 39 percent of GDP a primary surplus of the previous order is no longer necessary from a debt dynamics perspective, and the Turkish authorities, rightly in our view, see such a target as undesirable, given pressing needs for infrastructure investment and labor tax cuts, and given the need to take some sort of remedial counter measures in the face of a slowing global economy and tight monetary policy at the central bank.

Financial Markets

Turkish financial markets outperformed most of their peers in 2007, but then fell back significantly as the cloud of uncertainty hung threateningly over the AKP, only to rebound strongly again following the final Constitutional Court ruling. Equities rose 42 percent in local currency terms in 2007, while the benchmark bond yield fell by 460 basis points. Moreover, high interest rates and an appreciating currency made Turkey perhaps the most profitable “carry trade” destination throughout the year. The flip side has been strong exposure to global investor sentiment, as witnessed during the market turmoil in August 2007 and more recently in 2008, when Turkey was again among the hardest-hit emerging markets. Indeed, equities fell 22 percent during the January – July period, with bond yields and external spreads up 210 and 55 basis points, respectively, while the lira was down around12.5 percent against a euro-dollar basket. Since the start of July however, the stock markets have rebounded by some 18%, while the lira is up 12% against the dollar since the April 1 low.

Outlook on Key indicators

We expect GDP growth to have remained strong in the second quarter of 2008, but we now expect growth to slow further in the second half of the year. Industrial output (up 0.8% y-o-y in June) has slowed considerably and consumer confidence has been moving steadily downwards since March (suggesting much slower consumption growth in the second half of the year) although it did rebound slightly in July in anticipation of the Constitutional Court ruling. Export growth has remained reasonably strong, but this dynamic may change as Turkey sends nearly 50% of its exports to the EU, and the EU economies have now started to slow considerably.

The Turkish authorities have revised their 2008 growth forecast down from 5.5 percent to 4.5 percent, while the IMF are anticipating 3.95% growth for the year as a whole, a figure which seems to be a little nearer to the likely outcome. Economic activity in the second half is expected to benefit from recoveries in agricultural production, but be weighed down by slowing net export volume growth. At the same time, the outlook for private domestic demand seems to be looking up slightly following the rise in consumer confidence and the equity markets which have followed the Constitutional Court ruling, so we now anticipate 2008 GDP growth in the 4 – 4.5% range, with a slight acceleration in 2009 into the 5 – 5.5% range.

We see the current account deficit widening again in 2008 possibly to 6.5% of GDP. The lagged effects of 2007’s strong lira and surging oil prices are casting a shadow over net exports, and we expect this to continue as the external export environment worsens, while domestic demand continues to move forward. Uncertain prospects for growth in major trading partners pose a downside risk for exports, which is balanced to some extent by the drop in oil prices and a weakening of their impact on import values. We do not, however, anticipate any serious problems for Turkey in financing the deficit, and given that we do not anticipate any early loosening in the monetary stance of the central bank, we expect the upward drift in the value of the lira to continue.

The central bank is likely to continue to maintain the tightening bias in its interest rate policy, although further increases are unlikely in 2008 if agricultural output continues to improve and oil prices continue to fall. We do not accept the central bank view that the recent rise in inflation largely reflects adverse developments in food, energy, and administered prices. The weakening currency in a more uncertain global environment has also played a role, but internal “made-in-Turkey” components also exist – as evidenced by the sharp 18.41% increase in producer prices. So the Turkish central bank will need to keep a firm hand on the rate tiller in the immediate future, and try if it can to rival its Brazilian counterpart in competing for the reputation of being the “new bundesbank”.

The Turkish authorities are now looking for a primary surplus of 3.5 percent of GDP to create additional fiscal space for infrastructure investment (including major projects in poorer southeast areas), labor market reform, and higher transfers to sub national governments. The authorities view this stance as appropriately balancing macroeconomic concerns against microeconomic needs, and we by and large concur. We also see this approach politically both wise and expedient in the view of the tensions which exist inside the country and the serious need for political stability if the desired macroeconomic reforms are to be implemented.

Despite the significant strides forward, a number of key economic challenges are yet to be addressed. In the near term the heightened global risks remain and have even intensified. Domestic political tensions have subsided somewhat but are far from resolved, while any relief from the fall in energy prices may well be short lived. In addition Turkey faces a number of structural problems - including tax rates which are still high in comparison with competitors, a large informal economy, energy supply bottlenecks, and shallow financial intermediation, all of which need to be tackled to lift the potential growth rate.

Monday, August 18, 2008

Turkish Consumer Confidence Rebounds In July

According to Turkstat the increase in the Consumer Confidence Index stemmed from an improvement in consumers' assessments concerning their purchasing power in the current period as well as in the immediate future, together with a positive outlook on the general economic situation. Expectations about job opportunities and current propensity to buy durable goods were also up.

Some sort of increase in consumer confidence was only to be expected in July as optimism mounted that the ruling party would survive being closed by the Constitutional Court.

The main Istanbul Stock Exchange index shot up 18 percent between July 1 and July 29 as optimism mounted that the court would stop short of outlawing the ruling party. The final decision came on July 30, with the court limiting itself to warning the Justice and Development Party not to undermine the country's secular constitution.

Saturday, August 16, 2008

Turkey Central Bank Leaves Interest Rates Unchanged in August

Turkey's key rate, which is now the highest among developed and emerging economies, and the recent drop in oil prices are helping to slow consumer-price growth, according to a central bank statement on Aug. 5. The bank has added one and a half points to the rate since May as rising oil and food prices drove up inflation. Price growth reached 12.1 percent last month, the fastest pace in four years.

"Prolonged increases in food, energy and other commodity prices have

continued to exert significant upward pressures on headline inflation in the

second quarter of 2008. As a consequence, 6.8 percentage points of the 10.61

percent annual CPI inflation in June resulted from the direct impact of the food

and energy items"

Central Bank Inflation Report

Producer prices however seem to give the impression that there is still plenty of inflationary pressure coming along in the pipeline. Producer prices were up 1.5% on June prices in July, and by 18.41% over July 2007.

The lira was little changed at 1.1834 to the dollar after the bank decision was announced. The lira has now risen 12% since it hit a 2008 low of 1.3470 against the dollar on April 1 following the decision by the Constitutional Court to hear the case against the AKP, and has been rising steadily since.

In July, the bank raised its forecast for year-end inflation to 10.6 percent from 9.3 percent citing higher oil prices, which it estimated at an average price of $140 a barrel this year. Oil prices have slipped $30, or 21 percent, from the record $147.27 reached on July 11 on signs that global demand is falling because of record pump prices and a slowing economies.

Turkey's industrial output grew at just 0.8 percent in June, the slowest pace this year, according to data from the statistics office earlier this month.

Consumer confidence has set record lows in each of the five months through June.

On the other hand GDP growth accelerated in Q1, to an annual rate of 6.6% following a 3.4% rate in both Q3 and Q4 of 2007.

Tuesday, August 12, 2008

Turkey National Accounts Revision

Similarly, the new Labor Force Survey provides a better yardstick to measure the extent of the informal sector due to its increased sample size and accuracy. The incorporation of the 2000 Building Census, which shows a significantly greater stock of housing than previously estimated, also resulted in a significant upward revision to the value of paid and imputed rental services. Meanwhile, the use of finer levels of statistical disaggregation of products resulted in a much more reasonable series for changes in inventories, which in the previous national accounting system had reached implausible levels.

The new national accounts data feature an upward revision of nominal GDP for the years 1998-2006 of between 26 and 32 percent. On the production side, the revisions imply, above all, a larger weight of the service sector. This is matched, on the expenditure side, by a large upward revision in private consumption with balancing reductions in the investment and export shares.

The revision also altered recent growth dynamics somewhat, due to changes in relative prices resulting from the updating of the base year and improvements in methodology and coverage. The revised data show a smoother overall growth profile since 1998, with less contraction during the 2001 crisis, a commensurately weaker rebound, and somewhat stronger growth since 2004. Average growth over the period 1998-2006 increased by 0.4 percentage points, from 3.7 percent to 4.1 percent per year.

The data revisions naturally imply changes to several key economic indicators. The

upward revision to GDP has allowed Turkey to climb the ladder of international rankings of per capita income. At the same time, public debt and the current account deficit are now much lower in relation to GDP. However, gross external financing requirements remain the same in dollar terms, and several commonly used indicators of solvency, such as the ratio of public revenue to public debt and the ratio of exports to external debt, also remain unchanged. Meanwhile, several other indicators have worsened. The decline in the ratio of tax receipts to GDP, for example, suggests even less efficient tax collection than previously thought.

Wednesday, June 04, 2008

Turkey Central Bank Raises Inflation Target

The Turkish lira and stocks fell, and bond yields rose following the central bank decision. Turkey's lira fell 0.81 percent against dollar to close at 1.24. The Istanbul stock exchange shed 1.53 percent of its value. Yields on lira-denominated bonds rose as much as 26 basis points to a 14-month high of 20.28 percent in Istanbul.

The central bank has struggled to bring the inflation rate down toward 4 percent because of record oil and food prices. Faster inflation prompted the bank to raise its benchmark interest rate by a half point to 15.75 percent last month, the first increase in almost two years.

The government is committed to supporting the central bank in its inflation fight by paying down debt and preserving financial discipline, Simsek said. It is also ready to take ``precautionary measures'' in the banking industry to ensure lower inflation rates, he said without elaborating.

Since coming to power in 2002, the governing Justice and Development Party has reduced the country's debt stock and budget deficit to levels that meet the European Union's Maastricht criteria for adopting the euro. Its policies have also helped attract record levels of foreign investment and cut the inflation rate to a low of 6.9 percent last July from more than 30 percent.

Turkey's inflation rate rose to a 14-month high of 10.7 percent in May from 9.7 percent a month earlier, the government's statistics agency said yesterday. The price of unleaded fuel rose 7 percent from April and food prices jumped 16 percent.

Higher inflation means the bank will maintain its ``tight stance'' on interest rates, governor Durmus Yilmaz said in a letter to the government published late yesterday.

``Food and energy prices continue to pose risks to the medium-term inflation outlook and there is no clear evidence that this trend will reverse in the short term,'' Yilmaz said.

The bank will adopt policies aimed at beating the new inflation targets and not just meeting them, he added. Food and energy prices added seven percentage points to May inflation, the central bank said in a report published today. The inflation rate will probably remain high in the ``coming months'' due to the base effect from a year ago, the bank said. Inflation should start to slow in the fourth quarter, it added.

The central bank's monetary policy committee will meet on June 17 to decide whether to revise the benchmark interest rate.

Tuesday, June 03, 2008

Turkey Inflation May 2008

The Turkish Statistics Institute (Turkstat) said the consumer price index rose 1.49 percent month on month to an annual rate of 10,74%. The producer price index rose 2.12 percent month-on-month, with an annual rise of 16.53 percent.

Core inflation was also well above the central bank's year-end target of 4 percent.

The central bank raised its benchmark interest rate last month to 15.75 percent, reversing an easing cycle to hike for the first time since 2006, and has signalled it could tighten further.

As elsewhere, Turkey is suffering from the effects of food and oil price rises and the central bank has said it will take measures to prevent second-round effects.

But other factors also pushed the index higher in May.

Prices of clothing and shoes rose 11.99 percent month-on-month, while restaurant and hotel prices rose a higher-than-average 1.66 percent in the month. Stripping out energy, food, drinks, tobacco and gold, the CPI rose 6.30 percent year-on-year in May, Turkstat said.

Headline May inflation was also above a year-end forecast of 9.3 percent given by the central bank as recently as April. The bank forecasts inflation will end next year at 4.9-8.5 percent.

Inflation expectations have also continued to deteriorate, according to the central bank's twice-monthly surveys of economists and business leaders. In its latest poll, consumer price inflation was seen ending the year at 9.64 percent, and at 7.88 percent in 12 months' time.

Adding to inflation concerns, the lira has weakened as much as 14 percent this year, although high interest rates have helped it trim its losses back to 4.5 percent. The lira was broadly flat after the inflation data release.

Saturday, May 17, 2008

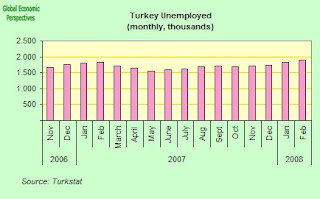

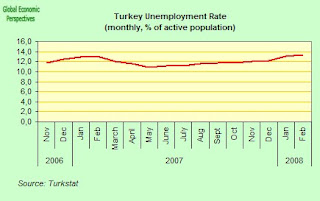

Turkey Employment and Unemployment February 2008

While non-institutional civilian population increased by 764 thousand persons and has reached to 69 million 372 thousand persons, non-institutional working age civilian population has increased by 737 thousand and has reached to 49 million 672 thousand persons in the period of February 2008.

Non-agricultural employment increased by 355 thousand

Number of employed persons increased by 104 thousand persons compared to the same period of the previous year and has reached to 20 million 162 thousand persons in the period of February 2008. Agricultural employment decreased by 252 thousand persons and non-agricultural employment increased by 355 thousand persons in this period.

Of those who were employed in February 2008; 23.6 % was employed in agriculture, 21.3 % was employed in industry, 5.1 % was employed in construction and 50.1 % was employed in services. Employment in agriculture decreased by 1.3 while that industry increased by 1 percentage points, construction increased by 0.4. The share of services was realized without any change.

Number of unemployed persons increased by 55 thousand persons compared to the same period of the previous year and has reached to 2 million 642 thousand persons in Turkey. Unemployment rate realized as 11.6 % with 0.2 points increase. Unemployment rate increased to 13.4 % with a 0.4 percentage points increase in urban areas and reached to 8.5 % with 0.3 percentage points decrease in rural areas.

Non-agricultural unemployment rate realized as 14.2 % without any change compared to the same period of the previous year in Turkey. The rate is realized as 13.4 % with a 0.1 percentage points increase for male and 17.5 % for female with a 0.2 percentage points decrease. In this period, of those who were unemployed.

Turkey Consumer Confidence April 2008

In March the index had fallen 6.44 percent month-on-month to 81.96 points, after falls in January and February.

The index, which was launched in December 2003, assesses consumers' spending behaviour and expectations, and the 100-point mark divides pessimism from optimism.

The index has only once fallen more sharply month-on-month - in June 2006 when it dropped 7.9 percent during a period of financial turbulence in Turkey, when the central bank was forced to raise interest rates sharply. With a background of rising inflation, the central bank hiked rates on Thursday for the first time since 2006.

Consumer confidence readings are going from bad to worse, as economic pressures continue to mount. There has evidently been a substantial decline in perceptions of the general economic situation.

Turkey's economic growth - which had been averaging 6.8 percent a year since a crisis in 2001 - has slowed down in the last year or so and full-year 2007 growth of 4.5 percent fell short of a 5.0 percent government target.

The government has lowered its 2008 gross domestic product growth forecast to 4.5 percent from an initial target of 5.5 percent, although the International Monetary Fund expects growth to come in at a lower 4.0 percent.

The statistics institute said the fall in the confidence index was related to a deterioration in consumers' expectations on purchasing power, the economic outlook and job opportunities in the coming period.

Turkish Central Bank Raises Base Rate in May

The bank was forced to reverse its policy of cutting rates after rising global oil and food prices helped push inflation in April to 9.7 percent. Turkey will miss its inflation target, currently at 4 percent, for a third consecutive year, central bank Governor Durmus Yilmaz said on April 30.

The secondary impact of a weakening in the lira and rising global energy and food prices would create a ``temporary'' increase in the inflation rate, the bank said in a press release after the decision. The bank would take further ``measured'' interest rate increases if necessary.

The Committee expects inflation to start decelerating in the last quarter of the year, ending 2009 at around 6.7 percent, as forecasted in the April Inflation Report. In the forthcoming period, monetary policy decisions will be geared towards keeping inflation close to these forecasts. Therefore, it is important that economic agents align their expectations with the Central Bank forecasts. The Central Bank will continue to take the necessary measures to prevent the potential second-round effects of the adverse developments in food and energy prices.

Accordingly, the Committee will consider the possibility of a further measured rate hike in the next meeting. The extent and timing of possible future rate hike will depend on developments in global markets, external demand, fiscal policy implementation, and other factors affecting the medium term inflation outlook.

On May 3, three days after Yilmaz said the bank was poised to increase rates, the government announced it was loosening its budget targets to step up spending on infrastructure and job creation. A $10 billion International Monetary Fund lending accord designed to slow inflation by curbing spending expired on May 10.

The government is raising spending after the economy expanded 3.4 percent in the fourth quarter of 2007, the same pace as the previous three months and the slowest in almost six years.

If the bank wants to offset inflation by nudging the lira back up then it seems to be having some of the desired effect since the lira posted its biggest weekly gain versus the dollar since September last week. The lira rose to the highest level in two months against the dollar, rising 1 percent on Friday to 1.2315 by 6:40 p.m. in Istanbul, its strongest level since March 19. It advanced 2.8 percent over the week, in the process paring its deline of 5 percent so far this year.

Extract From the Central Bank April Inflation Report

Inflation Developments

Food, energy and other commodity prices continued to have adverse

effects on inflation in the first quarter of 2008. Oil prices continued to rise and

averaged around 100 USD per barrel. Annual food price inflation remained at

elevated levels, reaching 13.4 percent in March. Moreover, rising financial

volatility and declining risk appetite on the back of ongoing global uncertainties

have led to exchange rate movements which had first round effects on March

inflation. Consequently, inflation rose to 9,15 percent at the end of the first

quarter, breaching the upper limit of the uncertainty band.

As a consequence 6.13 percentage points of the 9.15 percent annual CPI

inflation in March resulted from the food and energy items. Annual inflation in

core goods and services remained flat over the previous quarter, confirming

that the rise in inflation can be mostly attributed to factors beyond the control

of the monetary policy. Annual inflation in CPI excluding food,

energy and tobacco items was at 4.8 percent at the end of the first quarter.

Monday, May 12, 2008

Turkey Industrial Output March 2008

In the sub sectors level of industry, mining sector increased 12.4 %, manufacturing industry was up 1.9 %, electricity, gas and water increased by 3.8 % in March of 2008compared with same month of the previous year.

When the three-month average of 2008 is also compared to previous year, total industry sector increased 6.8 %, mining sector increased 10.9 %, manufacturing industry sector increased 6.3 %, electricity, gas and water sector increased 9.8 %.

The highest rates of increase were in the manufacture of motor vehicles, trailers and semi-trailers (26.0%), manufacture of electrical machinery (14.3%), wood and of products of wood and cork (12.6%).

Turkey, the IMF and Infrasturcture In the Kurdish East

Investors viewed the agreement, along with the prospect of European Union membership, as the two main anchors of the government’s reform agenda. The fact that the agreement is not being immediately replaced in the context of what is evidently a deteriorating global environment, worries many analysts who have become concerned that both the reform agenda and EU membership prospects may be faltering.

The $10bn agreement was obviously valuable for both parties since it achieved some notable successes, and has allowed the IMF to present Turkey as one of its more positive policy stories over the past five years. Lorenzo Giorgianni, head of the IMF’s Turkey monitoring team, said recently that the country had over-achieved in some key respects, given that some targets – such as GDP growth, public finances, debt ratios and reserves – were all above the initial targets.

However since the ending of the agreement fears have been voiced that the Turkish government may be loosening fiscal policy, and as evidence of this they point to this week's announcement by the government of the details of a $12bn additional investment package. However, before reaching any hasty decisions here we would do well to think about this package in more detail, about the value it may have at the present time in macro demand management terms, and in particular about its infrastructural focus and the fact that it is directed towards the Kurdish dominated provinces in the south-east, and thus as well as the immediate economic objectives the initiative could be seen as taking one tentative step in the direction of countering separatist sentiment and improving living standards in what is one of Europe’s most impoverished regions.

Recep Tayyip Erdogan, the Turkish prime minister, has said that as well as the infrastructural components the package will also include funding for cultural, educational and landmine-clearance initiatives. The entire investment is expected to create up to 3.8m jobs and free up for farming some 1.8m hectares of land.

Erdogan said TL1bn ($802m, €509m, £405m) of new funding would be added to the roughly TL15bn earmarked for spending in the region in April, when the government reduced some fiscal targets agreed with the International Monetary Fund in order to boost public spending between now and 2012. Mehmet Simsek, Turkey’s economy minister and also the person responsible for liaison with the IMF has indicated that the government wants to continue a close relationship with the fund, but it is seeking greater flexibility to raise public spending to address the huge backlog in infrastructure spending. Equally, at a time when private domestic demand is being held so tightly in check by the high interest rates being (sensibly) maintained by the central bank increasing public demand on worthwhile projects might seem like a reasonable policy option to maintain some growth momentum.

Mr Erdogan, speaking in Diyarbakir, Turkey’s main Kurdish city, described the package as “a well defined, scheduled, and funded action plan to remove regional differences in economic and social development, unemployment, and migration”. He said it would “constitute a social restoration to strengthen our social fabric, unity, and integrity”.

Most of the money is to be spent on irrigation and hydroelectric schemes under the banner of the South Anatolia Project. This vast state project, initiated in the 1970s, aims to harness the region’s rivers, including the Tigris and Euphrates, and to boost farm production and electricity generation. Given that one of the problems facing Turkey at the present time has been the high price of food products and energy, so anything which is realistic in policy terms and can help improve the situation in the longer term can only be welcomed I feel.

Monday, May 05, 2008

Turkey Foreign Trade March 2008

Over the same period, the foreign trade deficit was up by 25.4%, and reached 5,363 Million Dollars. In March 2008 exports coverage of imports was 68.1% while it was 67.7% in March 2007.

51.1% of Turkey's exports went to the European Union. In the January-March period exports to the EU totalled 16,937 Million Dollars and increased by 26.6% over 2007.

In January-March 2008, Turkey's main export partner was Germany with 3,402 Million Dollars an increase of 25.1%. In March 2008, exports to Germany was 1,166 Million Dollars and increased by 12.9% in comparison with the same period of the previous year. For exports, Germany was followed by Italy (705 Million Dollars), the UK (677 Million Dollars), France (598 Million Dollars), Russia (598 Million Dollars) and UAE (510 Million Dollars).

In January-March 2008, while the European Union Countries were the most intensive country group for imports (18,996 Million Dollars), followed by other European Countries (10,598 Million Dollars), Asian Countries (13,517 Million Dollars) and Free Zones in Turkey (357 Million Dollars).

In March 2008, the top country for Turkey’s imports was Russia (2,483 Million Dollars), records for imports range from Germany (1,633 Million Dollars), China (1,308 Million Dollars), Italy (974 Million Dollars) and the USA (864 Million Dollars).

For January-March 2008, road vehicles and their parts had by far the highest value of goods exported at 5,259 Million Dollars and then, iron and steel 2,742 Million Dollars, machineries, mechanical appliances, boilers, equipments and parts 2,531 Million Dollars, gold, pearl and other precious stone and products, coins 2,523 Million Dollars, articles of apparel and clothing accessories 2,132 Million Dollars.

At the same period, the top categories for imports were mineral fuels and mineral oils (10,932 Million Dollars) and then machineries, mechanical appliances, boilers, equipments and parts (5,858 Million Dollars) and iron and steel (5,357 Million Dollars).

New Turkey Deal With IMF In the Offing

The finance ministry said it was revising some key budget targets between 2008 and 2012 to release about 17bn new Turkish lira (YTL) ($13.4bn, €8.7bn, £6.8bn) for investment in infrastructure. The announcement is a sign that the government, pressured on the one side by strict IMF oversight and on the other by a serious political crisis, intends to pursue an ambitious public spending programme, much of it concentrated in Turkey’s unsettled south-eastern region.

The government’s ability to spend on infrastructure has been curtailed since 2002 by a $10bn (€6.5bn, £5bn) loan agreement with the IMF that set strict targets for public finances. The most visible of these was a primary surplus – the budget surplus before interest payments – that was once as high as 6.5 per cent of gross domestic product.

Kemal Unakitan, the finance minister, said the government was revising the primary surplus target down to 3.5 per cent for 2008 and to 2.4 per cent in 2012, after an upward revision of the size of the economy this year.

This year's budget aimed for a so-called primary surplus, excluding interest payments, equal to 5.5 percent of estimated economic output. Since then, the government's statistics office has revised its GDP forecast, increasing it by about a third and effectively reducing the budget target to about 4.2 percent. The primary surplus goal will be 3 percent next year, 2.7 percent in 2010, 2.5 percent the following year, and 2.4 percent in 2012.

The government aims to spend as much as 17 billion liras ($13.5 billion) over the next five years on the Southeast Anatolia Project, a $32-billion chain of hydro-electric dams and irrigation systems in the mainly Kurdish southeast, according to Economy Minister Mehmet Simsek. The project could ``double or triple'' farm output in area, he said.

The shift to increased public spending is unlikely in principle to worry the financial markets, given the underlying soundeness of Turkey’s YTL 750bn economy. What might concern investors, however, is that it coincides with an economic slowdown and heightened political tensions. There are indications that the central bank may well raise interest rates later this month to curb inflation, currently running at 9.7 per cent. Of course another reading which could be put on any decision to raise rates is that higher interest rates serve to underwrite the lira at a time of global uncertainty. If the bank fails to raise rates then this can be seen as a weakening in the will to fight inflation and the bank could lose credibility. But Turkey's economy has slowed considerably, inflationary pressure is more a by-product of global prices than of excess domestic demand, and arguably some parts of the economy need a boost. Hence the decision to loosen fiscal policy even as monetary policy is tightened.

The five-year investment programme includes funds to boost agricultural production in an attempt to keep food prices from rising excessively. However as we are seeing in one country after another, rising domestic food prices at a time when global prices are pushed up and up is one of the inevitable downsides of economic openness.

Saturday, May 03, 2008

Turkey Inflation April 2008

The highest monthly increase was 11,69% in the index for clothing and footwear by main expenditure groups. The indices rose for transportation 2,38%, for hotels, cafes and restaurants 1,74%, for food and non-alcoholic beverages 1,01%, for miscellaneous goods and services 0,79%, for housing 0,72%, for furnishings and household equipment 0,52%, for education 0,12%, for health 0,06%, for communication 0,04%, for alcoholic beverages and tobacco 0,03%, while the index declined for recreation and culture -0,13%.

The highest annual increase was in the index for housing.

The highest increase was 15,22% in the index for housing compared with the same month of the previous year. Food and non-alcoholic beverages (13,48%), hotels, cafes and restaurants (12,77%), miscellaneous goods and services (9,84%) were the other indices where high increases were realised.

The highest monthly increase was 2,99% in TRB2 (Van, Muş, Bitlis, Hakkari) among 26 regions (NUTS2).

The highest monthly increase in CPI by regional basis was in TRB2 (Van, Muş, Bitlis, Hakkari) (2,99%). The high increases in CPI were recorded in TRB2 (Van, Muş, Bitlis, Hakkari) region (6,72%) compared with December of the previous year, in TRB2 (Van, Muş, Bitlis, Hakkari) region (12,49%) compared with the same month of the previous year and in TRA2 (Ağrı, Kars, Iğdır, Ardahan) (9,69%) on the twelve months moving averages basis.

Prices of 299 items increased in total of 454 items covered in the index.

In April 2008 within average prices of 454 items in the index, average prices of 73 items remained unchanged while average prices of 299 items increased and average prices of 82 items decreased.

Turkey Producer Prices April 2008

Monthly oncreases were 2.87% in the index for agriculture and 4.90% the index of industry.

Th agriculture PPI increased 7.53% compared with December 2007, 18.83% compared with April 2007 and 11.98% on a twelve month average basis. The PPI for industry increased 11.91% compared with December 2007, 13.59% compared with April 2007 and 5,13% on a twelve month average basis.

The highest monthly increase in the PPI of industrial activities was recorded 19.40% in the index for metallic minerals.

There were increases 4.69% in the index for mining and stone quarrying, 4.92% in the index for manufacturing industry and 4.66% in the index for electricity, gas and water by sub-sections of industry.

The high rates of monthly increase in PPI by sub divisions were in the industrial price indices for metallic minerals (19.40%), for coke and refined petroleum (11.63%), for basic metal industry (11.62%), for crude petroleum and natural gas production (10.12%), for machinery and equipment (8.06%).

On the other hand index declined for tobacco products (-0,01%) compared with the previous month.

The high rates of annual increase were in the industrial price indices for metallic minerals (53,00%), for coke and refined petroleum (47,81%), for crude petroleum and natural gas production (47,75%), for basic metal industry (27,94%), for food products and beverages (18,96%).

Prices of 464 items increased in total of 756 items covered in the index.

In April 2008 within average prices of 756 items in the index, average prices of 189 items remained unchanged while average prices of 464 items increased and average prices of 103 items decreased.

Thursday, May 01, 2008

Turkey's Central Bank Maintains Its Inflation Forecast Despite Accepting It Isn't Valid

Mr Yilmaz blamed the deteriorating inflation outlook on rising energy and food prices. He said the soaring cost of oil and gas could add five percentage points to inflation next year. Rising food prices are also beginning to worry the government, which announced earlier this month that it would abolish import duties on rice

The bank has already missed its inflation target for 2006 and 2007. In an interview with the Financial Times earlier this year, the governor admitted missing the target for two successive years was “a huge credibility problem for the central bank”.

He argued at a news conference on Wednesday that there would have been no point in changing the official target in mid-year.

Thursday, April 17, 2008

Turkey Consumer Confidence Index March 2008

The index, which was 87.60 in February, declined to 81.96 in March, according to Turkstat data. The decrease derived from the deterioration in consumers' assessments concerning their purchasing power at present and in the next period, the general economic situation and job opportunities in the next period.

In terms of the sub-indices and percentage change, purchasing power index for the current period declined from 77.68 to 74.47 while purchasing power for the next period was down from 84.37 to 79.36 in March. The index of economic situation and job opportunities for the next period deteriorated from 81.83 to 74.93 and from 81.99 to 77.47 respectively last month, compared to February. Over the period, the index that indicates the appropriateness of the current period for purchase of durable goods fell from 112.14 to 103.58

Monday, March 31, 2008

Turkey Economic Growth Q4 2007

Agricultural output fell 9.7 percent in the quarter, while construction expanded 0.5 percent, compared with growth of 4 percent the previous quarter and 18.5 percent in 2006, when the economy as a whole grew 6.9 percent. Industrial production increased at an average rate of 5.2 percent in the fourth quarter.

Gross domestic product in 2007 was $659 billion, the agency said. Growth for the year was 4.5 percent. The government's target was 5 percent.

A court case to outlaw the ruling Justice and Development Party which is rumbling around in the background may also lead to political instability, further damping the economic expansion.

Consumer confidence has also taken a hit, and the index of consumer confidence fell from a previous high of 96.2 to 93.9 during the fourth quarter and in February hit 87.6, the lowest since records began in 2003.

Private consumption increased an annual 2.9 percent in the quarter, slowing from 8.2 percent three months earlier.

The central bank cut its benchmark overnight borrowing rate by a total of 2.25 percentage points to 15.25 percent between September and February before halting its reductions this month. Any pick-up in domestic demand will be limited by the impact of the global credit squeeze, central bank Governor Durmus Yilmaz said on March 13.

Tuesday, March 18, 2008

Turkey Consumer Confidence February 2008

The survey shows that consumer confidence declined from 92.12 in January to 87.6 in February. The index indicates an optimistic outlook if it is above 100 and a neutral outlook if it is equal to 100. When it is below 100 points, it means consumers are pessimistic about their future.

The decrease in the Consumer Confidence Index stemmed from a deterioration in consumers' assessments concerning their purchasing power for the present and coming periods, the general situation of the economy, job opportunities in the next six months and the "buying time conditions" of durable goods in the present period.

The index value of consumer purchasing power was 82.66 in December 2007 but retreated to 80.78 and 77.68 in the first two months of the year, respectively. Consumers are not anticipating an increase in their purchasing power in the coming six months, either, as they are expecting it to decrease by a further 2.63 percent.

The index for "buying time conditions" was also down in the survey, from 118.41 in January to 112.14 in February. Under this subtitle, the changes in the index values were as follows: probability of buying durable goods in the next six months (0.48 percent); probability of buying a car in the next six months (7.47 percent); probability of buying or building a home within the next 12 months (1.57 percent); probability of spending money on home improvements or renovations in the next six months (22.68 percent); probability of borrowing money to finance consumption expenditures in the next three months (-2.74 percent); "saving time conditions in the present time" (2.11 percent); probability of saving in the next six months (7.95 percent); expectation about the direction of price changes in the next 12 months (-5.38 percent).

Turkey Unemployment December 2007

The latest Household Labor Survey by the Turkish Statistics Institute (TurkStat) has shown that the unemployment rate in urban areas increased to 12.2 percent in December 2007, up by 0.3 percentage points over the same month last year, whereas in rural areas it increased to 8.1 percent, a 0.6 percentage point increase over the same period last year.

The non-agricultural unemployment rate was down by 0.3 percentage points to 13 percent. TurkStat's figures showed that 74.9 percent of those who were unemployed in December 2007 were male. The figures indicated that 57.8 percent of the unemployed had a below-high-school education level, 27.4 percent had been seeking jobs for one year or more, 32.5 percent were seeking jobs through "their acquaintances." Furthermore, 83.7 percent of them, 2.04 million people, had worked previously and, among those who were employed previously, 46.2 percent were employed in services, 23.2 percent in industry, 19.7 percent were in construction and the remaining 10.9 percent were in agriculture.

According to the figures, the working age population increased by 763,000 in December 2007 compared to the same period of the previous year. While the non-institutional civilian population increased by 756,000 and has reached 69.25 million persons, the non-institutional working age civilian population increased by 763,000, a total of 49.58 million.

The number of employed people decreased by 315,000 compared to the same period the previous year, totaling 20.44 million. The figures also shoed that the agricultural employment decreased by 508,000 and the non-agricultural employment increased by 193,000 in December 2007.

Of those who were employed in December 2007, 24 percent were employed in agriculture, 21 percent in industry, 5.5 percent in construction and 49.5 percent in the services sector. Of the people who were employed in this period, 75.3 percent were male, 60.5 percent had a below-high-school education level and 59.9 percent were regular or part-time employees, whereas 27.8 percent were self-employed or employers, and the remaining 12.3 percent were unpaid family workers. Other facts about this group include: 59.4 percent worked in establishments consisting of 1 to 9 employees, 2.5 percent had an additional job, 3 percent were seeking jobs either to replace their current job or to augment their existing job and 90.2 percent of regular employees were working in permanent jobs.

For the survey, a total of 37,385 sample households, 26,391 of which were from urban areas and 10,994 of which were from rural areas, were used. Of these, 31,850 households were interviewed and non-response forms were filed for various reasons for 5,535 households. In December 2007, the non-response rate was 13.3 percent in rural areas, 13.8 percent in urban areas and 13.7 percent for overall Turkey.

Monday, March 10, 2008

Turkish Foreign Trade January 2008

According to the provisional data from Turkstat, in January 2008; exports grew by 61.4% and reached to 10,596 Million Dollars and imports grew by 53.9% and reached to 16,306 Million Dollars compared with January 2007. At the same month, foreign trade deficit increased by 41.8%, reached from 4,027 Million Dollars to 5,710 Million Dollars.

In January 2008 exports coverage imports was 65% while it was 62% in 2007.

Exports to EU were 5,460 Million Dollars...

The weight of the EU in Exports has continued in January 2008. As compared with the same month of the previous year, exports to EU were 5,460 Million Dollars increased by 44.3%. The proportion of the EU countries was 51.5% while the proportion of Free Zones was 2.5% and other countries was 45.9%.

In January 2008, the main partner country for exports was Germany with 1,070 Million Dollars and increased by 39%. For exports, Germany was followed by the Switzerland (745 Million Dollars), UK (733 Million Dollars), Italy (678 Million Dollars), France (586 Million Dollars), and Russia (420 Million Dollars).

In January 2008, while the European Union Countries were the most intensive country group for imports (5,989 Million Dollars), followed by other European Countries (3,708 Million Dollars), Asian Countries (4,589 Million Dollars) and Free Zones in Turkey (140 Million Dollars).

For January 2008, the top country for Turkey’s imports was Russia (2,618 Million Dollars), records for imports range from Germany (1,463 Million Dollars), China (1,336 Million Dollars), Italy (852 Million Dollars) and USA (738 Million Dollars).

Road vehicles are forefront in exports according to chapters...

For January 2008, road vehicles and their parts has by far the highest value exported at 1,633 Million Dollars and then, pearl and other precious stone and products,coins 1,078 Million Dollars, machineries, mechanical appliances, boilers, equipments and parts 742 Million Dollars, iron and steel 729 Million Dollars, articles of apparel and clothing accessories 714 Million Dollars.

At the same period, the top categories for imports were mineral fuels and mineral oils (3,764 Million Dollars) and then machineries, mechanical appliances, boilers, equipments and parts (1,870 Million Dollars), iron and steel (1,730 Million Dollars), electrical machinery and equipment (1,340 Million Dollars).

Turkey Consumer Price Inflation February 2008

The highest annual increase was 14.75 percent in the housing index over same month of the previous year. Alcoholic beverages and tobacco prices increased by 14.34 percent; food and non-alcoholic beverages by 12.93 percent; and hotel, cafe and restaurant prices jumped by 11.02 percent.

The highest monthly increase in February was in food and non-alcoholic beverage prices, at 5.05 percent. The consumer price indices rose for miscellaneous goods and services by 1.73 percent; for hotels, cafes and restaurants by 0.90 percent; for furnishings and household equipment by 0.86 percent; for transportation by 0.54 percent; for housing by 0.39 percent; for communications by 0.12 percent; for health by 0.07 percent; and for alcoholic beverages and tobacco by 0.02 percent.

The indices declined for education by 0.03 percent, while for clothing and footwear dropped by 6.93 percent due to discount sales and campaigns. The index remained the same for recreation and culture. The highest price increase was for cucumbers, by 62.69 percent in February, while the price of green peppers rose by 45.51 percent. Women's boots saw the largest decline, at 12.14 percent.

Sunday, March 09, 2008

Turkey Producer Price Index February 2008

Monthly changes were 2.06% in the index for agriculture and 2,69% in the index for industry.

The agriculture PPI increased by 3.68% compared with December 2007, by 15.58% compared with February 2007. The industry PPI increased by 2.83% compared with December 2007, and by 6.45% compared with February 2007.

The highest monthly increase in the PPI of industrial activities was 21.32% in the index for electricity and gas.

There were increases 1.64% in manufacturing industry and 18.12% for electricity, gas and water and a decrease of 0,08% in the index for mining and stone quarrying.

The highest rates of monthly increase in the PPI were in the industrial price indices for electricity and gas (21.32%), for basic metal industry (6.55%), for wearing apparel (3.55%), for textile products (2.37%), for coke and refined petroleum (2.35%).

Tuesday, February 05, 2008

Turkey Inflation January 2008

While it is impossible to say that inflation has been tamed, it is certainly much more under control, and the declining overall trend in inflation rates continues. The central bank may well now cut key interest rates a further 0.5 basis points at the next meeting.

The highest monthly increase was 4,26% in the index for housing by main expenditure groups. The indices rose for miscellaneous goods and services 2,61%, for food and non-alcoholic beverages 1,83%, for transportation 1,33%, for communication 1,02%, for hotels, cafes and restaurants 1,00%, for furnishings and household equipment 0,61%, for health 0,17%, for education 0,02%, while the indices declined for alcoholic beverages and tobacco -0,01%, for recreation and culture -1,05%, for clothing and footwear -10,22%.

Tuesday, January 29, 2008

Turkey Labour Force Survey October 2007

While non-institutional civilian population increased by 913 thousand persons and has reached to 73 million 792 thousand persons, non-institutional working age civilian population has increased by 874 thousand and has reached to 52 million 796 thousand persons in the period of October 2007.

Non-agricultural employment increased by 170 thousand

Number of employed persons decreased by 55 thousand persons compared to the same period of the previous year and has reached to 22 million 750 thousand persons in the period of October 2007. Agricultural employment decreased by 225 thousand persons and non-agricultural employment increased by 170 thousand persons in this period.

Of those who were employed in October 2007; 25.9 % was employed in agriculture, 20.2 % was employed in industry, 6.2 % was employed in construction and 47.7 % was employed in services. Employment in agriculture decreased by 0.9 while that industry increased by 0.1 percentage points and services increased by 0.8. The share of construction is realized without any change.

Number of unemployed persons increased by 114 thousand persons compared to the same period of the previous year and has reached to 2 million 458 thousand persons in Turkey. Unemployment rate realized as 9.7 % with 0.4 points increase. Unemployment rate increased to 11.8 % with a 0.5 percentage points increase in urban areas and increased to 6.6 % with 0.2 percentage points in rural areas.

Non-agricultural unemployment rate realized as 12.3 % with 0.4 percentage points increase compared to the same period of the previous year in Turkey. The rate is realized as 10.7 % with a 0.4 percentage points decrease for male and 18.6 % for female without any change.

In this period, of those who were unemployed;

• 70.8 % were male.

• 54.8 % had education below high school.

• 29.4 % were seeking job for one year or more.

• Unemployed persons were commonly seeking job through “their acquaintances” (30.7 %).

• 80.8 % (1 million 987 thousand) had worked previously.

• Among those who were employed previously; 49 % were employed in “services”, 23.3 % were employed in “industry”, 17.8 % were employed in “construction”, 9.9 % were employed in “agriculture”.

In this period, of those who were employed;

• 74.6 % were male,

• 61.2 % had education below high school.

• 59 % were regular and casual employee, 27.2 % were self-employed and employer,

13.8 % were unpaid family worker.

• 61.1 % worked in establishments consisting of “1-9 employees”.

• 2.4 % had an additional job.

• 3.2 % was seeking job either to replace the current job or to augment the existing job.

• 86.8 % of regular employees worked in permanent jobs.

The ratio of persons who worked without any social security related to the main job declined to 46.9 % with 1.7 percentage point decrease. The share of persons who did not have any social security in agriculture decreased from 88 % to 87.6 % and that in non-agriculture decreased from 34.2 % to 32.7 % compared to the same period of the previous year.

Labour force participation rate (LFPR) decreased to 47.7 % with 0.7 percentage points decrease compared to the same period of the previous year for Turkey in October 2007 period. LFPR was realized as 71.6 % with 0.4 percentage point decrease for male and decreased to 24.4 % with 0.9 percentage point decrease for female. LFPR was 45.5 % with a 0.3 percentage point decrease in urban areas and 51.8 % with a 1.3 percentage points decrease in rural areas in this period. As for the distribution of labour force by education and age group;